Testing Framework Adoption Trends: 5 Years of npm Data

Playwright surged to 33M+ weekly downloads, overtaking Cypress and Selenium as the leading JS testing framework. Here’s what’s driving its rapid adoption.

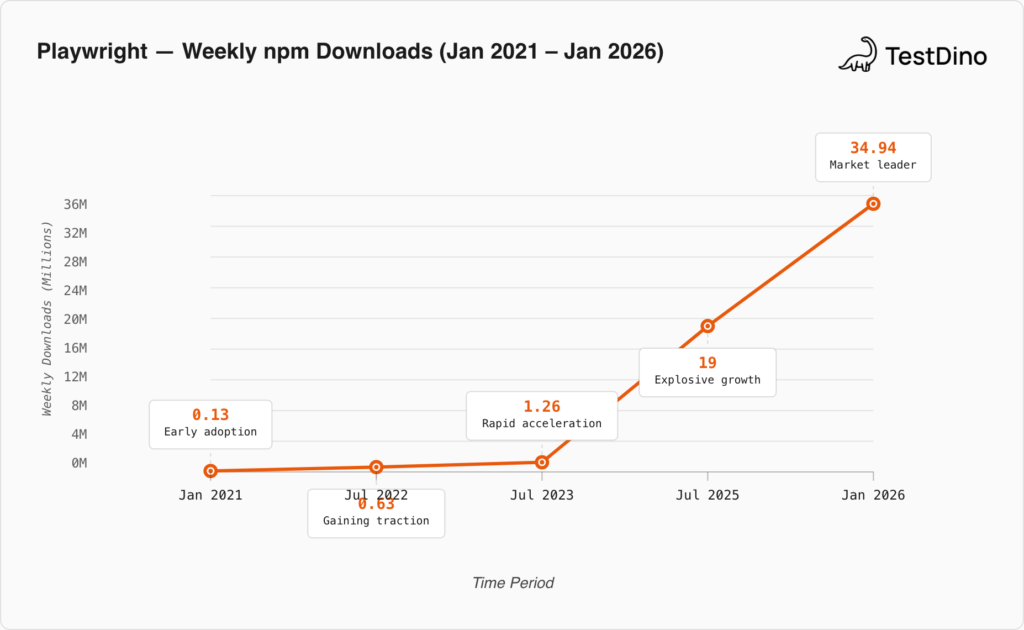

Playwright crossed 33 million weekly npm downloads in early 2026. In 2021, it was pulling under 1 million. That's roughly 70x increase in 5 years, a growth rate no other testing framework has matched in the history of the npm registry.

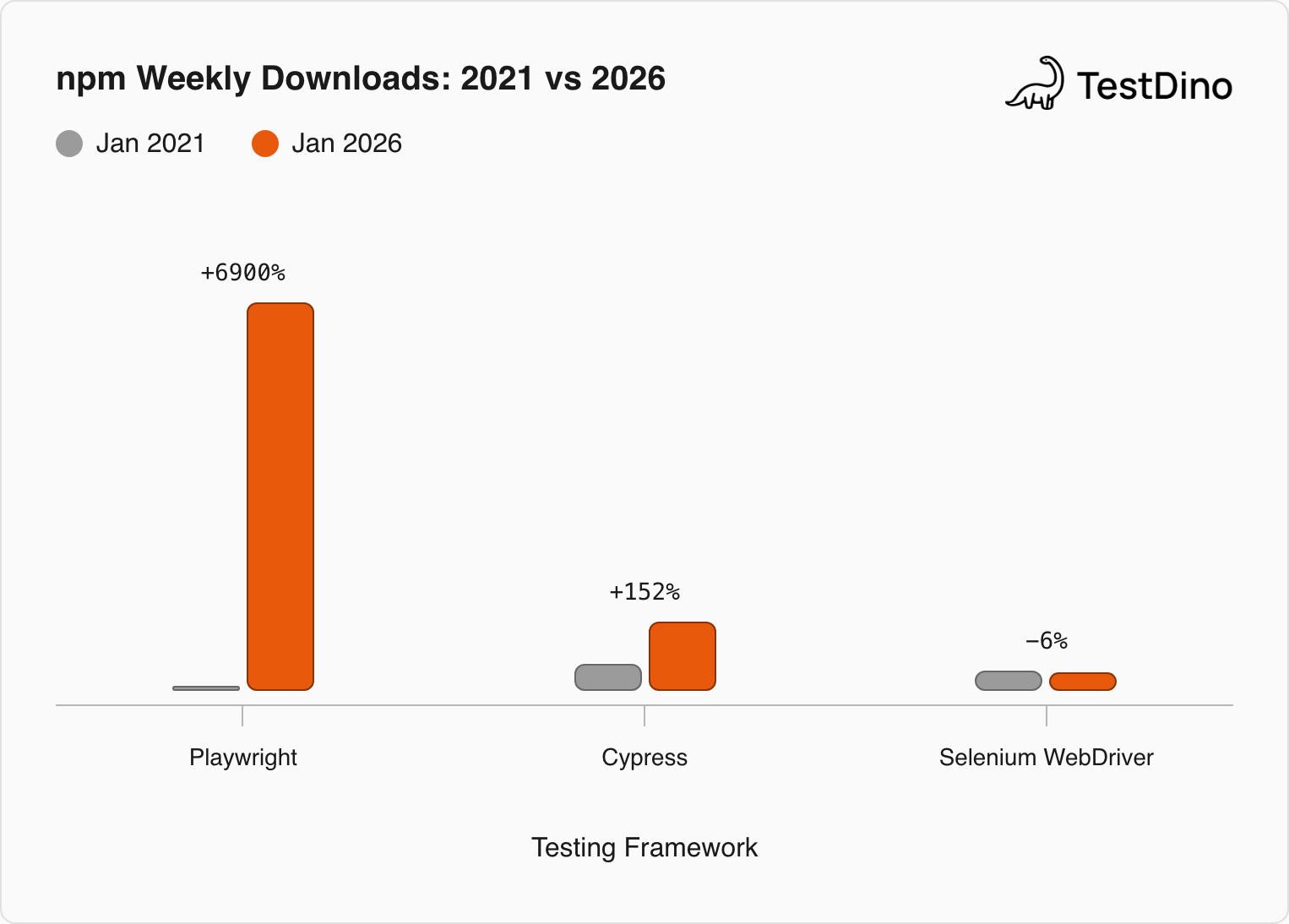

During the same period, Cypress held relatively flat between 5 and 6.5 million weekly downloads, and Selenium WebDriver drifted downward from its 2022 peak of roughly 2 million per week to around 1.7 million today.

The numbers don't leave much room for debate. What they do leave room for is context:

-

What drove these shifts?

-

When do the inflection points hit?

-

What does it mean for teams choosing a framework right now?

This analysis draws on five years of public npm download data (2021 through early 2026), supplemented by the State of JS survey (2020-2025), JetBrains Developer Ecosystem surveys (2023-2025), and GitHub repository metrics. All data is publicly available and independently verifiable.

The Five-Year Picture: 2021-2026 at a Glance

| Metric | Playwright | Cypress | Selenium WebDriver |

|---|---|---|---|

| npm weekly downloads (early 2021) | ~500K | ~2.5M | ~1.8M |

| npm weekly downloads (early 2026) | ~35M | ~6.3M | ~1.7M |

| Approx. 5-year growth | ~70x(3,200%) | ~2.5x(150%) | ~flat(-0%) |

| GitHub stars (Feb 2026) | 82,400+ | 49,500+ | 32,800+ |

| GitHub repositories using | 424,000+ | 200,000+ | 354,000+ |

| State of JS 2024 retention | 94% | ~66% | ~45% |

Sources: npm download comparison data (Feb 2026), Playwright GitHub repository (Feb 2026), State of JS (2024), TestDino Playwright market share analysis

The gap between Playwright and the rest is not just about total downloads. It's about trajectory. Cypress peaked in growth around 2022-2023 and has since leveled off. Selenium WebDriver's npm numbers have been on a slow decline since its 2022 peak.

For teams evaluating Selenium vs Cypress vs Playwright, these adoption curves provide one of the clearest data signals available.

When Playwright Overtook Everyone

Playwright's ascent followed a distinct pattern with identifiable inflection points.

2021: The Foundation Year. Playwright existed primarily as a browser automation library, competing with Puppeteer more than Cypress. The @playwright/test test runner shipped with version 1.15 in September 2021, giving Playwright its own testing framework identity. Weekly downloads sat below 1 million for most of the year.

2022: Early Traction. A ray.run analysis from mid-2023 using historical npm data found that @playwright/test had reached roughly 2.2 million weekly downloads, matching Selenium WebDriver's npm numbers at the time, but with a sharply upward trajectory while Selenium was flat. Cypress was pulling about 5 million weekly downloads and appeared dominant.

2023-2024: The Crossover. This was the period where Playwright's growth went from notable to dominant. The playwright package surged from around 8 million weekly downloads in late 2024 to over 20 million by mid-2025. State of JS 2023 data showed Playwright's usage rising from 9% to 15% among JavaScript developers surveyed, a 67% year-over-year increase. By the 2024 survey, Playwright had reached the highest retention rate (94%) of any E2E testing tool.

2025-2026: Clear Market Leader. npm data from late 2025 through early 2026 shows the playwright package fluctuating between 20-33 million weekly downloads depending on the snapshot date. TestDino's own Playwright market share analysis documented adoption across 424,000+ GitHub repositories and 4,484 verified companies, including Fortune 500 firms like Amazon, Walmart, Apple, NVIDIA, and Microsoft.

What drove this?

Multiple factors converged. Microsoft's backing provided corporate credibility. The built-in test runner (@playwright/test) eliminated the need for external frameworks. Auto-waiting, native parallel execution via sharding, multi-browser support out of the box, and the Trace Viewer for debugging solved longstanding pain points that Cypress and Selenium users had accepted as normal.

Cypress: The Plateau

Cypress didn't collapse. It plateaued.

npm data from 2023 through early 2026 shows Cypress holding steady between roughly 5 and 6.5 million weekly downloads. That's not a decline. But in a market where Playwright grew by multiples during the same period, standing still is falling behind in relative terms.

The State of JS survey tells a similar story. In the 2020 survey, Cypress had the highest satisfaction among E2E testing tools. By 2024, its retention rate had dropped below Playwright's 94%. The State of JS 2025 survey noted that Playwright, not Cypress, received the "Most Adopted" recognition, gaining +14% usage among respondents.

Several structural factors explain the plateau. Cypress runs inside the browser, which enables its interactive debugging experience but limits it to Chromium-based browsers. Teams needing cross-browser coverage with Firefox and WebKit have had to look elsewhere.

Cypress's parallel execution requires its paid Cloud service (formerly Dashboard), while Playwright offers native sharding for free. And Cypress's architecture struggles with multi-tab and multi-origin scenarios that modern web apps increasingly require.

For teams still on Cypress, the data suggests the framework remains stable and supported. The CMG engineering team noted in their State of JS 2024 analysis that they adopted Playwright and are "phasing out TestCafe" rather than Cypress, indicating that some teams choose Playwright for new projects while maintaining existing Cypress suites. This pattern of parallel adoption rather than wholesale replacement tracks with what we see in test management conversations across the industry.

Selenium: Down in npm, Alive in Enterprise

Selenium's npm story looks like a decline: from a peak of roughly 2 million selenium-webdriver downloads per week in 2022 to around 1.7 million in early 2026. But this is one of the most misleading metrics in the testing space.

Selenium is a polyglot framework. Its primary ecosystems are Java (via Maven) and Python (via PyPI), not JavaScript. npm captures only one slice of Selenium's usage. Enterprise teams building test automation in Java with TestNG or JUnit, the bread and butter of large-scale Selenium deployments, don't show up in npm data at all. For a fuller picture of Selenium's actual position, see the Playwright vs Selenium comparison, which addresses multi-language adoption.

What npm data does tell us: within the JavaScript ecosystem specifically, Selenium is no longer the default choice for new projects. Teams choosing a JS/TS framework for E2E testing in 2025-2026 are overwhelmingly choosing Playwright or Cypress. The JetBrains 2024 Developer Ecosystem survey found that among JavaScript developers specifically, Cypress was at 15% usage, with "Mocha, Vitest, and Playwright all hovering around the 10% mark". But Playwright's growth rate since that survey makes it likely the gap has closed or reversed.

Selenium's GitHub stars (32,800+) trail Playwright (82,400+) and Cypress (49,500+), but its repository usage (354,000+) remains massive, reflecting its installed base across decades of adoption.

The data doesn't say Selenium is dying. It says the JavaScript testing market has moved to Playwright and Cypress, while Selenium retains its position in multi-language enterprise environments.

The Supporting Cast: WebdriverIO, TestCafe, Puppeteer

Not every framework is a three-horse race. npm data reveals what happened to the other contenders.

| Framework | Weekly Downloads (Feb 2026) | Trend |

|---|---|---|

| Puppeteer | ~6.3M | Stable (not a testing framework per se) |

| WebdriverIO | ~800K (est.) | Stable with niche audience |

| TestCafe | ~100K (est.) | Declining steadily |

Source: npm (Feb 2026). Puppeteer numbers reflect its use as a browser automation library beyond testing.

Puppeteer holds solid download numbers, but it occupies a different niche. It's a Chromium-only browser automation library, not a full testing framework. Many of its downloads come from web scraping, PDF generation, and screenshot tooling rather than test automation. Playwright's architecture was born from the Puppeteer team at Google (the core Puppeteer developers left Google for Microsoft and built Playwright), giving Playwright natural advantages that have steadily pulled testing users away from Puppeteer.

WebdriverIO maintains a loyal community, particularly among teams that want a testing framework built on the WebDriver protocol. It supports multiple browsers and has strong integration with Appium for mobile testing. But its growth is flat compared to Playwright's curve.

TestCafe has been declining since 2023. The CMG engineering team's State of JS 2024 analysis noted they are "in the process of phasing out TestCafe" in favor of Playwright. For teams currently on TestCafe, migration planning is worth considering.

What's Driving Adoption: Beyond the Numbers

Download numbers measure what teams install. Surveys and community signals help explain why.

Developer satisfaction drives adoption. The State of JS data shows a clear pattern: tools with the highest retention rates grow the fastest. Playwright's 94% retention and +14% year-over-year usage growth track with this pattern. When developers try Playwright and like it, they stay. Teams that invest in understanding the full Playwright CLI and toolchain tend to find immediate productivity gains.

CI/CD integration matters. GitHub Actions has become the dominant CI service, with 62% of developers using it for personal projects and 41% for organizational work. Playwright's native GitHub Actions support, built-in sharding for matrix strategies, and frictionless CI/CD integration make it a natural pairing with the most popular CI platform. The academic analysis of CI service adoption found that GitHub Actions' combined market share among repositories with CI already exceeds 50%.

AI tooling is accelerating Playwright adoption. The rise of AI coding agents (GitHub Copilot, Claude Code, Cursor) has created a secondary adoption driver. Playwright's clean API and strong TypeScript support make it more compatible with AI-assisted test generation than older frameworks. The emergence of Playwright MCP and Playwright Skills for AI agents creates a feedback loop where AI tools recommend Playwright, increasing its adoption further. The JetBrains 2025 survey found that 85% of developers now regularly use AI tools for coding and development.

Market conditions favor modern frameworks. The global automation testing market was valued at USD 35.52 billion in 2024 and is projected to reach USD 169.33 billion by 2034, expanding at a CAGR of 16.90%. MarketsandMarkets estimates a similar trajectory, projecting the market at USD 55.2 billion by 2028 at a 14.5% CAGR from a 2023 base of USD 28.1 billion. Grand View Research puts the 2030 figure at USD 92.45 billion, growing at 17.3% CAGR. The variation in estimates reflects different market definitions, but the direction is unanimous: rapid growth, which benefits the framework best positioned for modern CI/CD environments.

What This Means for Engineering Teams

If you're choosing a testing framework for a new project in 2026, the npm data makes Playwright the default answer for JavaScript and TypeScript teams. The ecosystem momentum, developer satisfaction data, and growth trajectory all point in one direction. For teams looking to adopt, the Playwright cheatsheet is a good starting point for getting up to speed quickly.

If you're maintaining an existing Cypress or Selenium suite, the data doesn't say you need to drop everything and migrate today. Cypress remains well-supported with millions of weekly downloads. Selenium's multi-language enterprise ecosystem is not going anywhere. But the data does suggest that new investment should go toward Playwright: new test suites, new projects, new team training.

And if you're tracking framework health over time, the metrics that matter are clear: npm download trends, GitHub activity, survey retention rates, and CI provider compatibility. These are the signals that predicted Playwright's rise before the industry consensus caught up, and they'll predict the next shift too.

If your team already runs Playwright, tracking suite health and stability across runs becomes the next challenge. Tools like TestDino provide reporting and analytics that connect download-level adoption trends to the operational reality of running test suites at scale. Because choosing the right framework is only step one. The real work is making your tests fast, stable, and actionable, and understanding the right reporting metrics is how you get there.

Data Sources and Methodology

This analysis uses the following publicly available data:

npm download statistics from npm trends: Compare NPM package downloads and npm-stat: download statistics for NPM packages for packages: playwright, @playwright/test, cypress, selenium-webdriver, webdriverio, testcafe, and puppeteer. npm download counts reflect package installs from the registry and serve as a widely used proxy for adoption in the JavaScript ecosystem. They include CI/CD installs and automated builds, so they skew higher than the number of actual users but are consistent across tools.

State of JS surveys (2020-2025), an annual survey of JavaScript developers run by Devographics, covering satisfaction, usage, and interest metrics for testing libraries.

JetBrains Developer Ecosystem surveys (2023-2025), surveying 23,000-26,000 developers globally across all languages and ecosystems.

GitHub metrics, including stars, repository usage, and contributor activity from the official Playwright, Cypress, and Selenium repositories.

One limitation worth noting: npm data only captures the JavaScript/TypeScript ecosystem. Selenium's massive usage in Java and Python (via Maven and PyPI, respectively) is not reflected in npm usage. We address this in the Selenium section above.

FAQs

Table of content

Flaky tests killing your velocity?

TestDino auto-detects flakiness, categorizes root causes, tracks patterns over time.